Because technical analysis can help investors recognize market trends and anticipate future price movements of an asset, reading crypto charts is crucial for traders seeking the finest market chances.

Using historical data, known as “technical analysis,” investors may predict how an asset’s supply and demand will affect its price. Investors can make more educated selections by studying crypto market charts and anticipating when bullish and bearish trends will conclude.

Table of Contents

Upward price movement supported by purchasers (bulls) is called a bullish trend. Bears, or sellers, are responsible for a downward price trend. Hence this is considered a bearish trend. Traders can use technical analysis to their advantage by analyzing price patterns and trends on charts.

If you want to keep tabs on the crypto market, the most significant charts can help, but they have limitations.

The Meaning of Crypto

Cryptocurrencies allow for the anonymous and secure transfer of funds online. To see how crypto works, we need to break it into its components.

How Blockchains Can Help You

All cryptographic currencies have their origins in data science. Bitcoin and its underlying blockchain technology are the finest means of conceptualizing the basics of cryptocurrency. Blockchains are dynamic databases that are accessible from multiple locations simultaneously. Blockchains provide robust security against tampering, leaks, and breaches because they apply cryptographic procedures. Cryptography truly comes into its own when it keeps data secure during its collection, storage, and validation.

In their simplest form, blockchains are digital ledgers that record all cryptocurrency transactions.

It is important to note that no one entity (business, government, or individual) controls a blockchain. Instead, blockchains are hosted by a network of computers throughout the world. These databases are continually updated with new monetary transactions validated by specific computers. While hackers may be able to break into a single computer, they would need to control every machine in a blockchain network to change or delete entries, adding to the cryptocurrency’s overall security.

Most blockchains are public, open-source projects for the sake of transparency. This means that cryptocurrencies have an extra layer of responsibility, as independent validators may quickly identify errors.

Connected blockchains are necessary for cryptocurrencies to work. The Bitcoin protocol was published in 2009 by an unknown programmer (or group of programmers) using the alias Satoshi Nakamoto. Bitcoin demonstrated in practice that monetary transactions could be conducted over the internet without the need for a bank by relying on a decentralized blockchain network that would record every exchange.

The Process of Crypto Mining

The process of crypto mining that makes cryptocurrencies usable for purchases, sales, and exchanges is another use of data science. Individual computers can mine enormous data sets using sophisticated data mining techniques to provide validation and maintenance services to blockchains. Computers that validate these datasets in this way are rewarded with small amounts of the cryptocurrency (usual fractions of a single coin) mined by the same computer.

Adding new coins to the blockchain “confirms new transactions and is a vital component of the blockchain ledger’s upkeep and development,” as explained by Investopedia. Individuals can generate fresh cryptocurrency on their computers without needing to purchase any.

Using Candlesticks to Analyze Data

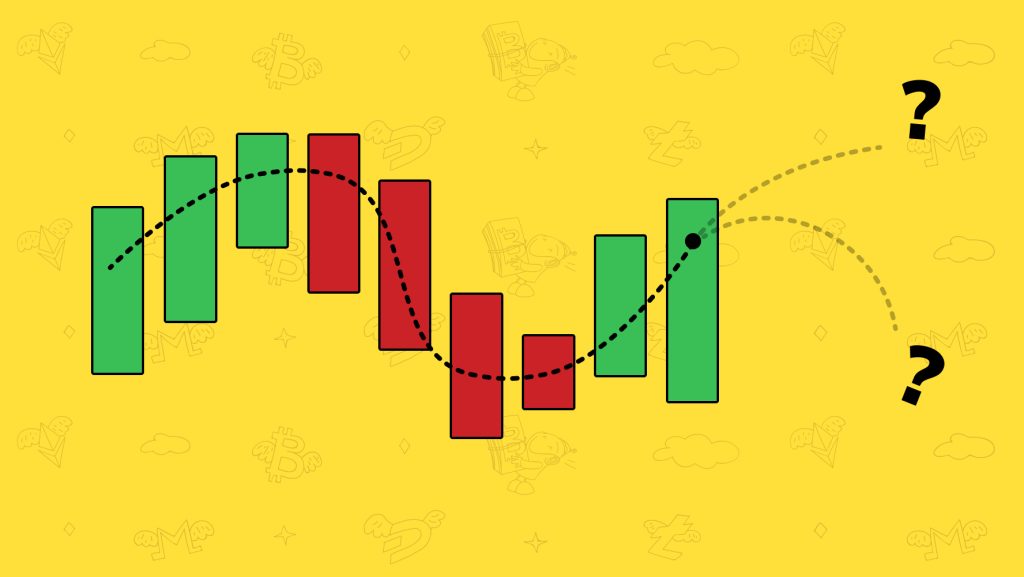

All the data you need to make trading decisions based on crypto prices may be found in candlestick charts. These charts allow you to undertake technical analysis and make educated guesses about when to enter and leave a trade. Many distinct patterns can be seen in candlestick charts, which can then be used to forecast market movements.

So, let’s start with the basics: what are candlesticks?

First, let’s look at what candlestick charts look like before we get into the various insights they might yield.

A quick response: On a price chart, a candlestick indicates the high, low, open, and close prices for a specified period, typically a day.

In price charts, candlesticks are points or shapes that can provide information about an object. They have a central “shadow” component and smaller “wicks” that light the interior.

Conclusion

To technical analysts, patterns in an asset’s previous trading activity and price fluctuations provide insight into how that asset’s value will likely change. It can be used for stocks, futures, commodities, currencies, and cryptocurrencies, basically any purchase for which there is historical transaction data.

Charles Dow, publisher, editor of the Wall Street Journal, and co-founder of Dow Jones & Company, is widely credited as the inventor of technical analysis. Dow Jones Transportation Average was the first stock market index, and he helped create it (DJT).